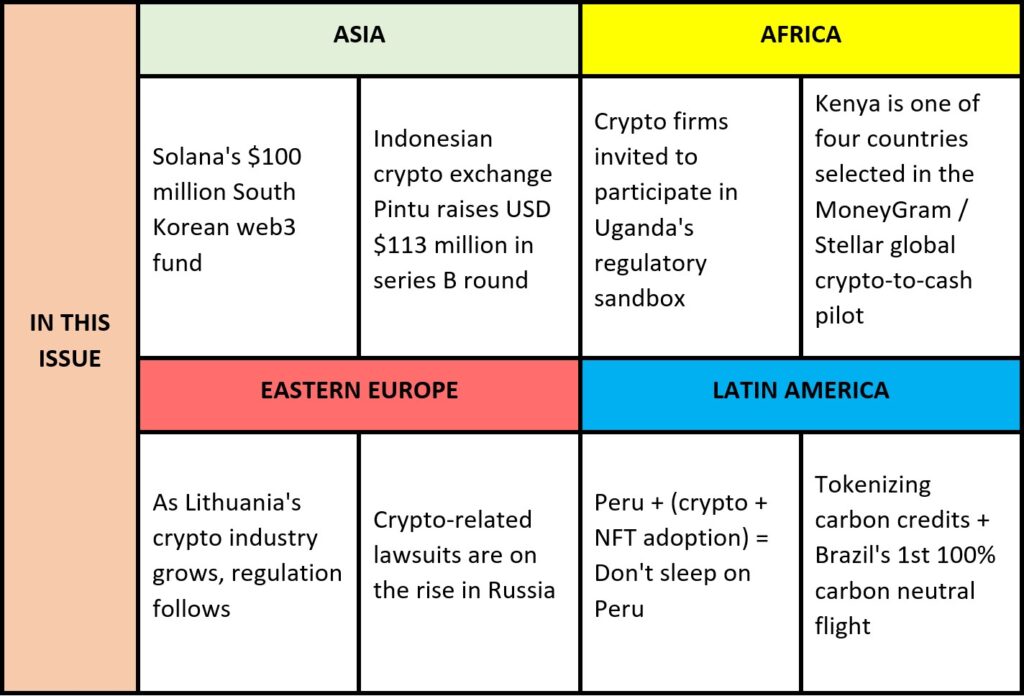

This is EmergingCrypto.io’s weekly newspaper. To receive this in your inbox on Monday morning, you may subscribe here!

All the emerging market blockchain & crypto news you need in less than 5 minutes

Want to read this in another language? Use the language selector at the top of this page and select your preferred language.

EmergingCrypto.io Weekly Update June 5 – June 11

Asia

Solana’s $100 million South Korean web3 fund

South Korea is gaining a reputation as an important emerging blockchain and web3 economy. Johnny Lee, general manager of games at Solana Labs, said that “a big portion of Korea’s gaming industry is moving into web3”. Last week Solana Ventures and Solana Foundation launched a USD $100 million web3 fund focused exclusively on South Korea’s GameFi, Non-Fungible Tokens (NFTs), and Decentralized Finance (DeFi) startups. Commenting on the fund, Lee said, “[Solana wants] to be flexible; there’s a wide range of project sizes, team sizes, so some of [our investments] will be venture-sized checks.” (Read more on EmergingCrypto.io; Read more on Blockchain.News)

Indonesian crypto exchange Pintu raises USD $113 million in series B round

The 4th most populous country in the world and 25th on Chainalysis’ 2021 Global Crypto Adoption Index, Indonesia is home to the cryptocurrency exchange, The door. With more than four million users, Pinto just raised USD $113 million in a series B round. Pintu plans to expand its service offerings within Indonesia by providing new products and services such as NFTS and DeFi to users. Series B investors included Pantera Capital, Lightspeed India Partners, Intudo Ventures and Northstar Group. (Read more on EmergingCrypto.io; Read more on Blockchain.News)

Africa

Crypto firms invited to participate in Uganda’s regulatory sandbox

In June 2021, the Bank of Uganda (BOU), Uganda’s central bank, launched a regulatory sandbox to “promote financial services innovation, attract capital, and funding for fintech firms and provide shared learning opportunities for innovators and regulators.” At the time crypto companies and products were neither mentioned nor invited to participate in the sandbox. However, the central bank made a U-turn after talks with the Blockchain Association of Uganda (BAU). In a letter to the BAU, the BOU invited BAU member companies to familiarize themselves with the sandbox regulations and framework. This invitation is a nod of support for blockchain and crypto adoption in Uganda and the development of the local crypto economy. Uganda is ranked 65th out of 157 in Chainalysis’ 2021 Global Crypto Adoption index. (Read more on EmergingCrypto.io; Read more on Bitcoin.com)

Kenya is one of four countries selected in the MoneyGram / Stellar global crypto-to-cash pilot

Global money transfer firm, MoneyGram, and the Stellar Development Foundation (SDF), the organization behind the Stellar blockchain, have announced the first four markets for the initial rollout of their global on/off-ramp service for digital asset wallets, US, Canada, Philippines, and Kenya. Kenya is ranked 5th in Chainalysis’ 2021 Global Crypto Adoption index and the highest rank among these four countries. Enabled by the Stellar blockchain, Stellar digital wallets, MoneyGram’s retail agent network, and Circle’s USDC stablecoin, users will be able to (1) move funds between cash, crypto, and back to cash seamlessly without a bank account, (2) go to MoneyGram locations to load up and cash out their crypto holdings, and (3) settle their funds in near-time with USDC. (Read more on EmergingCrypto.io; Read more on BitcoinKE)

Eastern Europe

As Lithuania’s crypto industry grows, regulation follows

Lithuania’s crypto industry is blossoming quickly from eight entities established in the Baltic nation in 2020 to over 250 today. The country’s rapidly growing crypto industry has attracted more stringent regulations. Lithuania is revising its money laundering and terrorist prevention law to further regulate crypto service providers’ operations. More detailed Know Your Customer (KYC) rules will be introduced, anonymous accounts won’t be permitted, capital requirements for service providers will increase to €125,000, and only permanent residents of Lithuania will be allowed to manage crypto companies. Furthermore, updated rules are also meant to prevent Russia from circumnavigating sanctions by laundering money in Lithuania. (Read more on EmergingCrypto.io; Read more on Bitcoin.com)

Crypto-related lawsuits are on the rise in Russia

The Cybersecurity company, RTM Group, conducted research on the increase in lawsuits related to crypto in Russia. In 2021, there were 1,531 lawsuits, the majority of which were related to drug trafficking and money laundering. Bankruptcy cases related to cryptocurrency ownership also doubled in 2021. Debt collection from the illegal use of electricity for underground crypto mining amounted to over 61.5 million rubles (over USD $1.1 million at current rates). (Read more on EmergingCrypto.io; Read more on Bitcoin.com)

Latin America

Peru + (crypto + NFT adoption) = Don’t sleep on Peru

Crypto and NFT adoption in Peru is increasing and is one of the highest in Latin America. Almost 10% of the entire population currently owns NFTs and Peru is positioning itself as the Latin American country with largest number of NFT owners behind only Venezuela, Argentina, and Colombia, both of which have over 10% of the population owning NFTs. According to Chainalysis’ 2021 Global Crypto Adoption IndexPeru is one of the top countries globally and ranked at #22. In Latin America Peru is ranked fifth behind Venezuela, Argentina, Colombia, and Brazil. Bottom line, don’t sleep on Peru. (Read more on EmergingCrypto.io; Read more on Cointelegraph)

Tokenizing carbon credits + Brazil’s 1st 100% carbon neutral flight

Rounding off this week’s newspaper, Mossthe company behind the MCO2 token that tokenizes carbon credit on Ethereum, in partnership with GOL airlines and CVC, announced last week the completion of the first 100% carbon neutral flight in Brazil from São Paulo to Maceió. The round-trip flights emitted approximately 44 tons of CO2, equivalent of 276 trees. 44 MCO2 tokens were purchased to generate the 44 carbon credits needed for offsetting. When MCO2 tokens are purchased, a digital certificate is provided, and the amount invested in CO2 compensation will be 100% reverted to certified projects to support the conservation of the Amazon Forest. (Read more on EmergingCrypto.io; Read more on Cointelegraph)

Thanks for reading! Have a great week ahead!

Written by Jon Lira. Connect with him on LinkedIn and Twitter.

Was this email forwarded to you? Sign up here

Want more EmergingCrypto.io?

More emerging market blockchain and crypto news:

- Newly-Launched NFT Marketplace, Ayoken, Raises $1.4 Million to Build Out Platform for African Creatives (Read more on EmergingCrypto.io; Read more on BitcoinKE)

- Ugandan Cross-Border Crypto-Fiat Money Transfer App, EverSend, Re-Brands as it Plots Growth (Read more on EmergingCrypto.io; Read more on BitcoinKE)

- Crypto exchange Binance seeks critical licenses in Philippines, CEO says (Read more on EmergingCrypto.io; Read more on Cointelegraph)

- New Japanese law may allow seizure of stolen crypto (Read more on EmergingCrypto.io; Read more on Cointelegraph)

- Bill to ban digital assets as payment introduced in Russian parliament (Read more on EmergingCrypto.io; Read more on Cointelegraph)

- Mastercard will guarantee the security of Mercado Livre’s cryptocurrency purchase and sale service in Brazil (Read more on EmergingCrypto.io; Read more on Cointelegraph)

- Stablecoins issued by private banks will not need to be 100% backed by Real Digital (Read more on EmergingCrypto.io; Read more on Cointelegraph)