This is EmergingCrypto.io’s weekly newsletter. To receive this in your inbox on Monday morning, you may subscribe here!

EmergingCrypto.io Weekly Update March 13 – March 19

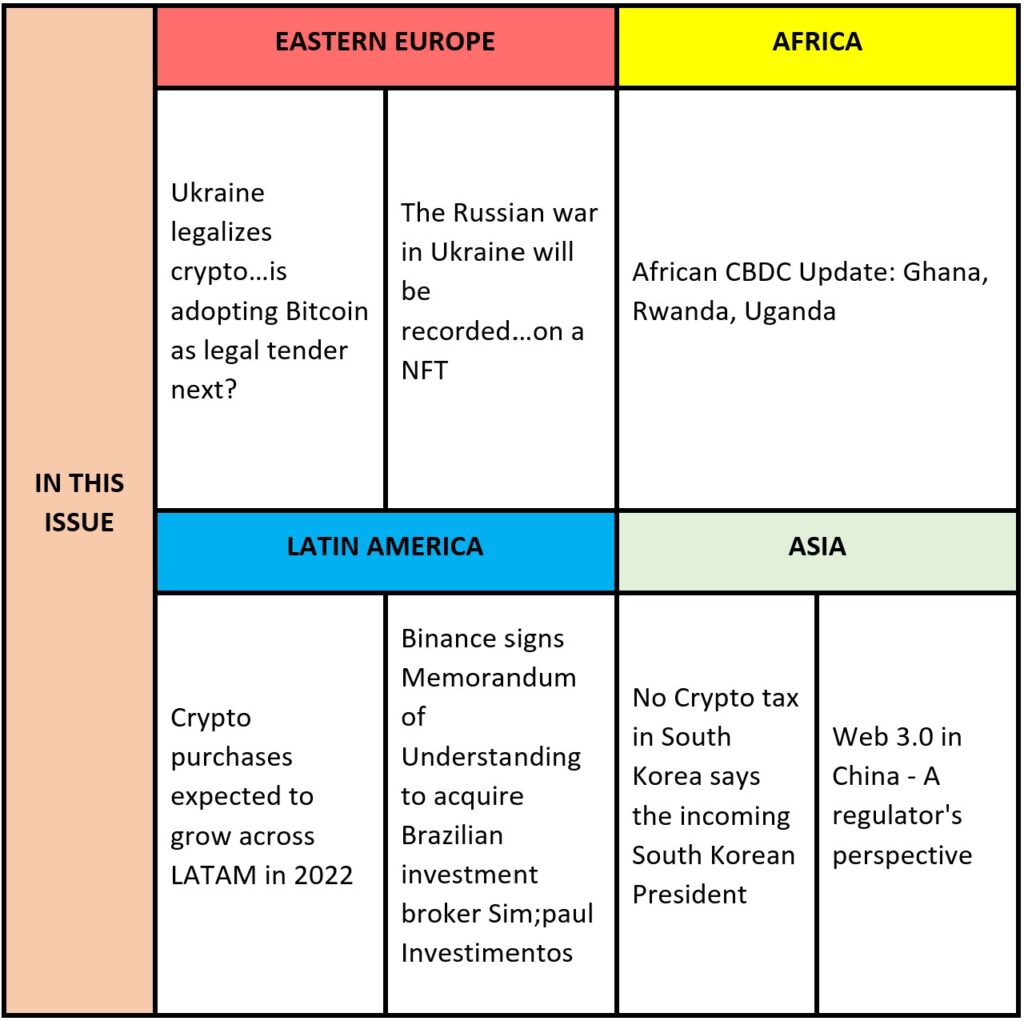

Eastern Europe

Ukraine legalizes crypto…is adopting Bitcoin as legal tender next?

In a press release from The Ministry of Digital Transformation of Ukraine last week, President of Ukraine Volodymyr Zelensky signed the Law of Ukraine “On Virtual Assets”. This does NOT make Bitcoin or other cryptocurrencies legal tender in Ukraine like how Bitcoin is legal tender in El Salvador. However, it creates conditions for the launch of a legal market for virtual assets in Ukraine. The law (1) determines the legal status, classification and ownership of virtual assets, (2) identifies who the market regulators are, (3) creates conditions for further formation of the legal field in the market of virtual assets, (4) determines the list of providers of virtual assets and conditions of their registration, and (5) provides for the implementation of financial monitoring measures in the field of virtual assets. The new market will be regulated by Ukraine’s National Securities and Stock Market Commission. (Read on EmergingCrypto.io; Read on The Ministry of Digital Transformation of Ukraine)

The Russian war in Ukraine will be recorded…on a NFT

The Ukrainian government is jumping on the NFT bandwagon to fund the war effort in the ongoing Russian war. However, the NFTs won’t be like Bored Apes or Crypto Punks, they will be illustrating stories from its war with Russia. The Ukrainian Deputy Minister of Digital Transformation, Alex Bornyakov, was quoted in The Guardian last week and indicated that “each token would carry a piece of art representing a story from a trusted news source.” The funds raised will be used to fund media activities and buy military equipment. Bornyakov said, “We [aren’t using these] fund to buy weapons at this point. We’re buying night vision goggles, optics, helmets, [and] bulletproof vests.” (Read on EmergingCrypto.io; Read on Blockchain.News)

Africa

Several countries across Africa have been working on CBDCs. In this week’s newsletter we’ll be highlighting three updates that were reported last week from across the continent.

Ghana

Last week the Bank of Ghana (BoG), its central bank, unveiled the latest details of its digital Cedi. In effort to address financial inclusion, its proposed CBDC, the eCedi, will be available for offline use to in order to connect and include rural communities as part of its design in the likely future of the country’s digital currency. As part of its design, the CBDC will be able to be stored locally on a card, on a phone, or smart device, and can be passed from one user to another. Additional design features highlighted include (1) accessibility by both the general public and businesses, (2) support for low value payments and utilizing the existing payment infrastructure, (3) mitigate potential risks for banking system disintermediation, (4) the ability to handle large volumes of transactions, (5) 24/7 availability, and (6) support for instant payments. (Read on EmergingCrypto.io; Read on BitKE)

Uganda

Meanwhile, the Bank of Uganda has begun exploring the viability of issuing a CBDC for both households and businesses. Uganda has a very high unbanked population with 72% of the population without a bank account. Ugandan regulators are worried about how a CBDC will address financial inclusion for elderly and rural Ugandans that may be unfamiliar with the technology and not have access to the Internet. However, like other African countries, mobile phone payments are prevalent in Uganda. CBDC supporters argue that implementation will allow Ugandans to move money quickly and cheaply. (Read on EmergingCrypto.io; Read on Ledger Insights)

Rwanda

Rwanda-based The New Times reported last week that the Central Bank of Rwanda will indicate their position for or against a CBDC by December 2022. Rwanda’s central bank Deputy Governor, Soraya Hakuziyaremye, said, “[Rwanda is] now at an investigation phase. We are analyzing what could be the benefits to Rwandans to have [a] CBDC but also the risk not only to our economy but the sector depending on the form of digital currency we would issue…What is important is to look at financial inclusion because if you issue a digital currency, you shouldn’t be excluding your population, it has to go with closing the digital divide and making sure that people have the option to use it.” (Read on EmergingCrypto.io; Read on BitKE)

Latin America

Crypto purchases expected to grow across LATAM in 2022

Sherlock Communications released their report on blockchain in Latin America covering individual country and regional updates and sentiments on blockchain and crypto regulation, adoption, and ecosystems. Latin America has experienced growth in the number of users being onboarded to local crypto exchanges, expanding the user base and acceptance of the technology. According to the survey, Latin Americans are keen to invest in crypto to protect their assets from economic crisis as well as to receive remittances from family members overseas. However, price volatility across the different cryptocurrencies and the potential for a government ban are reasons why people in the region may be hesitant to embrace the technologies. (Read on EmergingCrypto.io; Read on Blocknews)

Binance signs Memorandum of Understanding to acquire Brazilian investment broker Sim;paul Investimentos

Last week Binance signed a Memorandum of Understanding to acquire Brazilian-based broker, Sim;paul Investimentos. This acquisition would give Binance a foothold into the traditional brokerage house that already has permission to operate in the Latin American giant. Brazil is seen as a growth market to Binance. Its CEO and co-founder, Changpeng Zhao, said, “At Binance, our goal is to grow adoption of crypto around the world to generate a positive impact for our users, the crypto and blockchain community, and society in general. In a fast-developing market like Brazil, crypto can transform and facilitate people’s lives and as such we believe – in full collaboration with local authorities – that Binance has a lot to contribute in developing the community and ecosystem in Brazil.” (Read on EmergingCrypto.io; Read on Blocknews)

Asia

No Crypto tax in South Korea says the incoming South Korean President

South Korean President-Elect and crypto-enthusiast, Yoon Suk-yeol, has vowed to not tax South Korean crypto gains exceeding 50 million won, or roughly $40,000 USD. President-Elect Yoon’s crypto stance is a stark difference from outgoing President Moon Jae-in’s administration who maintained a more hawkish position against crypto in South Korea. The incoming Yoon administration’s crypto views could mean that South Korea will see more innovation and expansion of its blockchain and crypto industries and market. (Read on EmergingCrypto.io; Read on Blockchain.News)

Web 3.0 in China – A regulator’s perspective

Rounding off this week’s newsletter in China, the director of the Science and Technology Supervision Bureau of China’s Securities Regulatory Commission, Yao Qian, wrote an op-ed in the China Financial Journal on Web 3.0 that covered topics from the history of web 1.0 to web 3.0, to web 3.0 development recommendations. Although China has banned cryptocurrencies and mining in the country, the Chinese government has been supportive of blockchain technology. In the case of web 3.0, the very well written and thoughtful op-ed demonstrates the thought leadership at the regulator-level that exists in China that is consistent with other resources and thought leaders on what is web 3.0 and why it is important. (Read on EmergingCrypto.io, Read on Cointelegraph)

Thanks for reading and have a great week ahead!

Written by Jon Lira. Connect with him on LinkedIn and Twitter.

Was this email forwarded to you? Sign up here