This is EmergingCrypto.io’s weekly newspaper. To receive this in your inbox on Monday morning, you may subscribe here!

All the emerging market blockchain & crypto news you need in less than 5 minutes

Want to read this in another language? Use the language selector at the top of this page and select your preferred language.

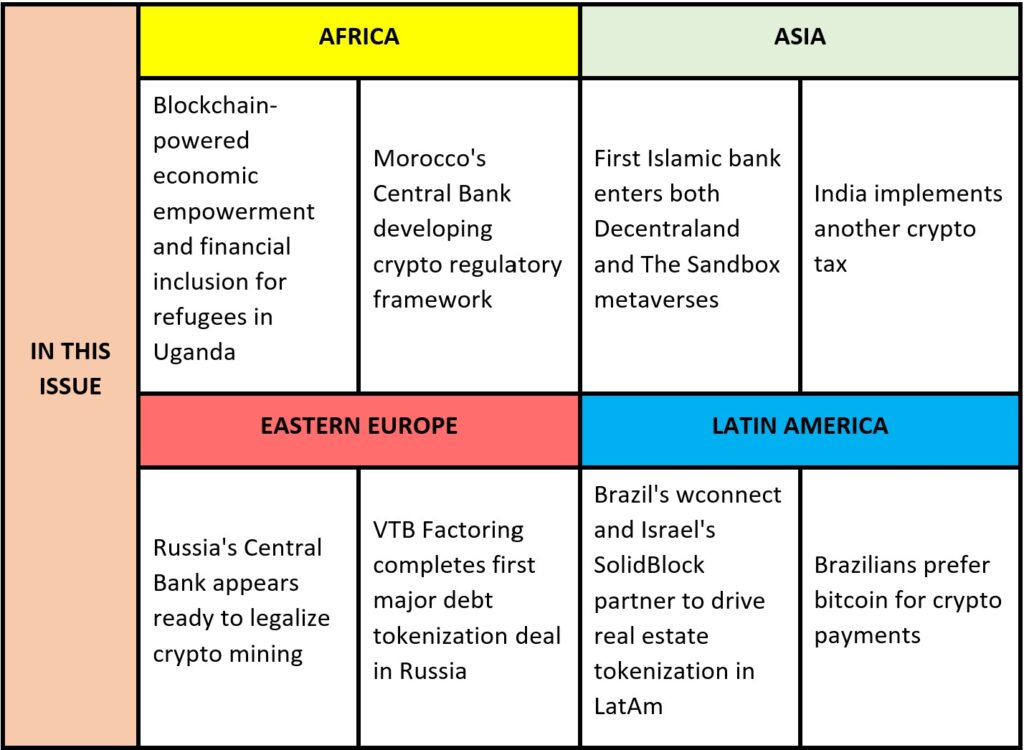

EmergingCrypto.io Weekly Update June 26 – July 02

Africa

PARTNERSHIP: Blockchain-powered economic empowerment and financial inclusion for refugees in Uganda (4 minute read)

Ugandan digital transformation advisory firm, Savannah, is partnering with Coinbase and Mercy Corps to launch two pilots aimed at addressing financial inclusion and economic empowerment for refugees in Uganda. According to the UNHCR, Uganda hosts the largest refugee populations in Africa, and the 3rd-largest in the world, at more than 1.5 million. The first pilot is a blockchain-based digital ID platform to verify identity and facilitate digital transactions. The second pilot will provide each participant from the first pilot a digital wallet to be able to send, receive, store, and spend cryptocurrencies. The two pilots will work with 35,000 refugees.

REGULATION: Morocco’s Central Bank developing crypto regulatory framework (1 minute read)

Abdellatif Jouahri, the governor of Morocco’s Central Bank, Bank Al-Maghrib (BAM), announced at a press briefing that the Central Bank is working to adopt a crypto regulatory framework that combines technology, innovation, and consumer protection. The governor stressed that the BAM has consulted with both the International Monetary Fund (IMF) and the World Bank over benchmarking and that the framework will also upgrade the country’s anti-money laundering and anti-terrorist financing rules. A timeline has not been provided yet when a bill might be presented for review and approval.

Asia

METAVERSE: First Islamic bank enters both Decentraland and The Sandbox metaverses (2 minute read)

Warba Bank is the latest bank and the first Islamic bank to set up a presence in the metaverse. The Kuwaiti bank is enthusiastic to be a pioneering financial institution to support their young clients and opted to set up shop in both Decentraland and The Sandbox. Warba Bank Executive Vice President for Support Services and Treasury, Anwar Bader Al-Ghaith, said, “The world of virtual reality is used in several advanced fields, including services, education, health and others. And Warba Bank aims to be close to its clients in virtual reality to introduce its products and services, as well as communicating with them in an innovative way that reflects Warba Bank’s image as a pioneer in digital transformation.”

TAX: India implements another crypto tax (3 minute read)

Last Friday, July 1st, India began to enforce a 1% tax on the sale and transfer of crypto assets more than 10,000 Indian rupees, roughly USD $126. This is the second crypto tax this year that the Indian government has imposed. At the beginning of April, a 30% tax was enacted on all crypto income, and trading volumes on Indian exchanges declined by as much as 70%. Indian crypto exchanges worry that this additional tax will further impact revenues as trading volumes are expected to decline further. Although the sales and transfer tax is meant to track transactions and adhere to anti-money laundering and anti-terrorism rules, Indian exchanges feel that the tax will continue to drain liquidity from the system and push traders out of the country.

Eastern Europe

REGULATION: Russia’s Central Bank appears ready to legalize crypto mining (3 minute read, original article in Russian)

Kirill Pronin, director of the financial technologies department for the Central Bank of Russia, commented last week that the Central Bank is ready legalize crypto mining, however, on one condition: the sale of the proceeds earned in the mining process should take place outside of Russia. Pronin wants to avoid the accumulation of cryptocurrencies in Russia and any motivation for use in domestic settlements. As of January 2022, Russia is the 5th largest country to mine bitcoin according to the Cambridge Bitcoin Electricity Consumption Index.

DEALS: VTB Factoring completes first major debt tokenization deal in Russia (3 minute read, original article in Russian)

VTB Factoring, a subsidiary of Russian state-owned VTB Bank, announced last week that it has completed Russia’s first debt tokenization deal with Russian engineering company, Metrowagonmash. The debt was issued on the fintech platform Lighthouse. CEO of VTB Factoring, Anton Musatov, said, “The new commercial debt financing technology makes it much easier for Russian businesses to access capital to solve operational problems.” CEO of Lighthouse, Denis Jordanidi, commented, “We are sure that the first successful experience of issuing a digital financial market will not only contribute to the emergence of a new financial instrument in Russia, but will also lay the foundation for an innovative business practice for working with borrowed capital for many interested companies in Russia.”

Latin America and the Caribbean

PARTNERSHIP: Brazil’s wconnect and Israel’s SolidBlock partner to drive real estate tokenization in LatAm (2 minute read, original article in Portuguese)

wconnect, a Brazilian big data and real estate tokenization consultancy, will become the exclusive Latin American distributor of SolidBlock, an Israeli Tokenization as a Service (TaaS) platform for real estate. SolidBlock has been looking for a partner in Brazil, Latin America’s largest country and one of the largest markets for cryptocurrencies in the region with around 10 million investors. wconnect estimates that over $1.5 trillion in real estate development is needed in Brazil by 2030 and according to its CEO, Mauricio Conti, real estate tokenization brings liquidity and new sources of funding to the market.

PAYMENTS: Brazilians prefer bitcoin for crypto payments (1 minute read, original article in Portuguese)

Rounding off this week’s newspaper, 77% of crypto payments Brazilians make are with bitcoin, followed by ether, according to a survey released by digital currency payment processing firm, CoinPayments. Brazilians prefer bitcoin because it is the first and most well-known digital currency. Rubens Neistein, Brazil Country Manager at CoinPayments, commented, “We have seen a large movement of acceptance of bitcoin in the Brazilian market. More than an asset for investment due to the possibility of financial return, it stands out as a form of payment. Especially in the current moment of digital transformation and economic uncertainty of the [Brazilian] real.” Crypto-based payments have also gained acceptance in other countries in Latin America and around the world where there have been currency devaluations, such as in Argentina and Venezuela.

Thanks for reading and have a great week ahead!

Written by Jon Lira. Connect with him on LinkedIn and Twitter.

Was this email forwarded to you? Sign up here

Want more EmergingCrypto.io?

More emerging market blockchain and crypto news:

- 9 Out of 13 African Countries Chasing CBDCs Are in Research Phase, Says The IMF

- China’s BSN chair calls Bitcoin Ponzi, stablecoins ‘fine if regulated’

- Singapore central bank says cryptocurrencies have ‘no fundamental value’

- Uzbekistan Presents Registration Requirements for Cryptocurrency Miners

- Taiwan considering both wholesale and retail CBDC

- Russia’s Financial Watchdog Investigates 400 Crypto-Related Cases, Director Tells Putin

- El Salvador buys more bitcoin and Bukele thanks investor for ‘selling cheap’