This article is from forkast.news and the original article can be read here

A lawsuit involving a lien over a non-fungible token (NFT) being wrangled out in Singapore could have global implications when it comes to determining the oversight legal institutions have over digital assets, experts say.

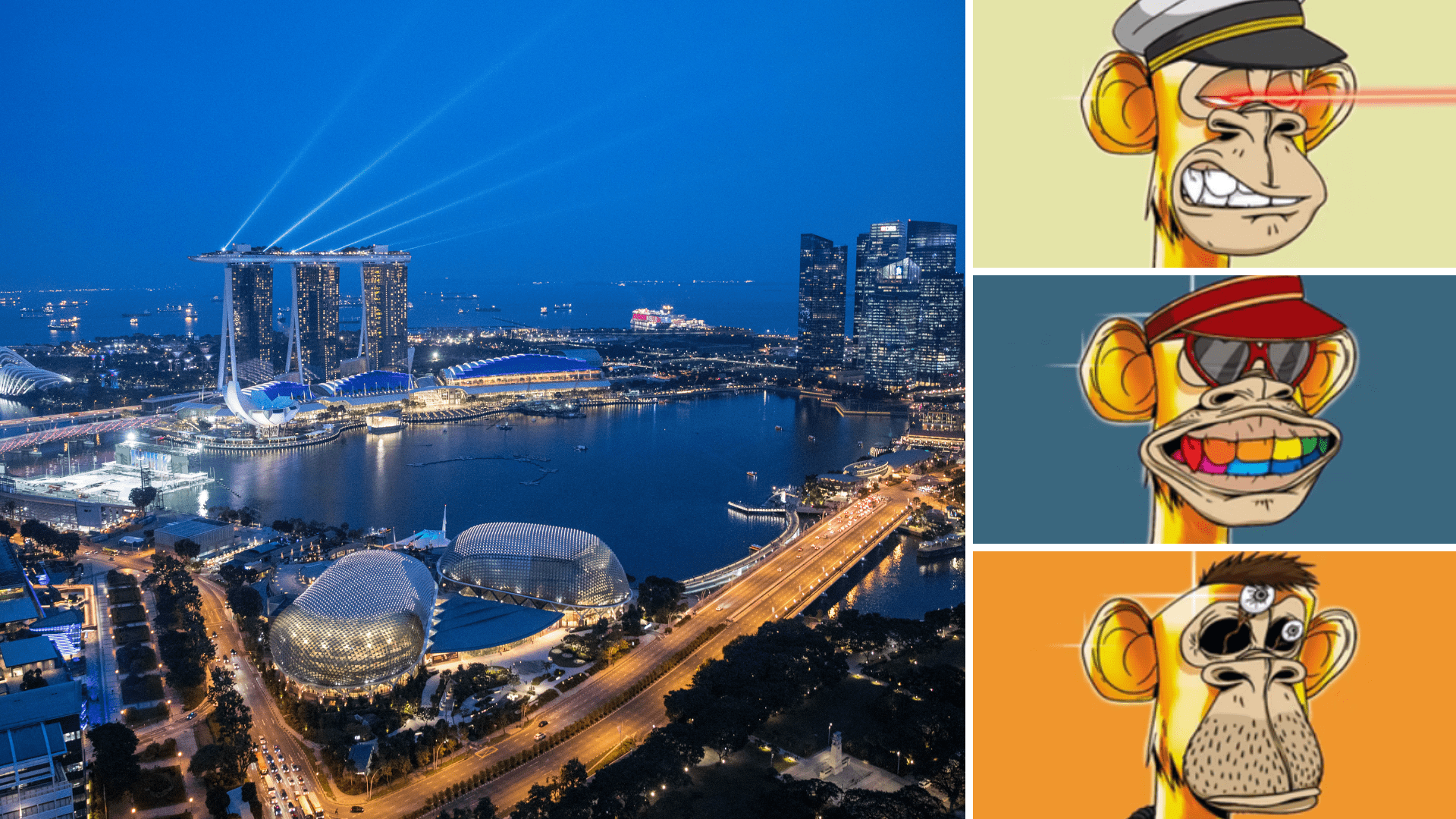

In a ruling released on Monday, the High Court of Singapore placed a proprietary injunction on an NFT, enforceable globally. The Hon. Justice Lee Seiu Kin blocked any potential sale and transfer of ownership of the Bored Ape Yacht Club (BAYC) #2162 NFT — worth an estimated US$500,000. The defendant, identified in court papers as “chefpierre,” has the right to respond.

The ruling comes as courts around the world grapple with lawsuits in a relatively nascent industry that has thrived in an environment of low interest rates. Global sales of NFTs reached US$18.5 billion in 2021, 570 times higher than the previous year, according to the State of the NFT Market report by Forkast. The report’s partner, CryptoSlam, expects NFT sales to surpass US$30 billion in 2022.

NFT sales have already crossed US$16 billion in sales so far this year, according to CryptoSlam data.

In late April, a court in the Chinese city of Hangzhou ruled that marketplaces allowing the trade of NFTs bore responsibility for keeping out fakes. Days later the U.K.’s High Court ruled that NFTs are private property in a watered-down ruling that applies the definition to only the token and not the artwork it represents.

The long arm of the law

“This ruling confirmed that NFTs are valuable property worth protecting and that courts are able to take jurisdiction over digital assets in the digital blockchain,” Shaun Leong, a partner for International Arbitration & Litigation at Withers KhattarWong LLP, told Forkast. The Singapore-based law firm represented the claimant.

Leong’s client is a high net worth NFT investor from Singapore who owns several BAYC. The client, whose representative spoke to Forkast under the condition of anonymity, reportedly used the NFT as collateral to borrow Ether from “chefpierre” on an Ethereum-based decentralized finance (DeFi) loan. The Ether was staked back into the network to earn interest.

As part of the agreement with the lender, “chefpierre,” the NFT was placed into an escrow wallet for safekeeping. When “chefpierre” foreclosed the loan, he transferred the NFT to his own personal wallet, Leong said.

The case is also unique as it allows for court papers to be served via social media, in this instance, Twitter, as “chefpierre” is a public figure who posts regularly on Twitter, and believed to hold a relatively senior position in the team at metaverse game Gino’s Big Town Chef, Withers KhattarWong said. The orders could also be served on Ethereum’s platform, the law firm claimed.

The proof in the pudding

While the Singapore court’s decision may be a significant milestone for digital asset litigation, enforcing the ruling is another challenge altogether, the chief executive officer of Singapore International Mediation Centre Chaun Wee Meng told Forkast.

“How do you injunct something like that?” Chaun said. “There’s a whole host of problems that will come about in a traditional [court ruling].”

Different jurisdictions may have mechanisms to enforce a proprietary injunction like this; however, the pseudonymous nature of the defendant means it is difficult to know which jurisdiction they reside in.

Which is why perhaps the courts may have believed that words may be louder than actions in this instance.

“The thinking is that anyone who wants to spend half a million (U.S. dollars) on an artwork would at least Google it first,” Leong said. “And the hope is that news reports that ownership over the NFT is being disputed can help prevent a sale until at least after the substantive dispute has been resolved,” he added.

While the NFT is still listed on OpenSea, it has been flagged for suspicious activity.

Data on OpenSea shows the NFT has been traded, but not sold, seven times within the past week, potentially between accounts controlled by “chefpierre” himself, perhaps in an effort to obfuscate the exact location of the asset. Forkast has reached out to “chefpierre” for comment, but he has not responded at press time.

If “chefpierre” were to sell the NFT, Leong told Forkast, he could be held in contempt of the Singaporean court as well as attract civil liability charges by third parties who bought the assets without the ability to obtain the full title over the NFT.

The calm before the storm

Monday’s ruling is also significant as it suggests that code in smart contracts is not necessarily law.

“That brings us to the coming war,” Leong said. “Some people feel code is law, whereas now you are beginning to see judicial decisions from all over the world … which seems to suggest that code is not necessarily law.”

In the meantime, the blockchain does offer some solutions to this problem; if mediators or decision-makers in disputes were given the ability to execute or mend smart contracts, that would obviate all enforcement concerns, Leong said.

Though calling this idea revolutionary, he also admitted it would be tough to implement it on a large scale as it runs contrary to the crypto world’s ethos of decentralization.

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. EmeringCrypto.io does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.