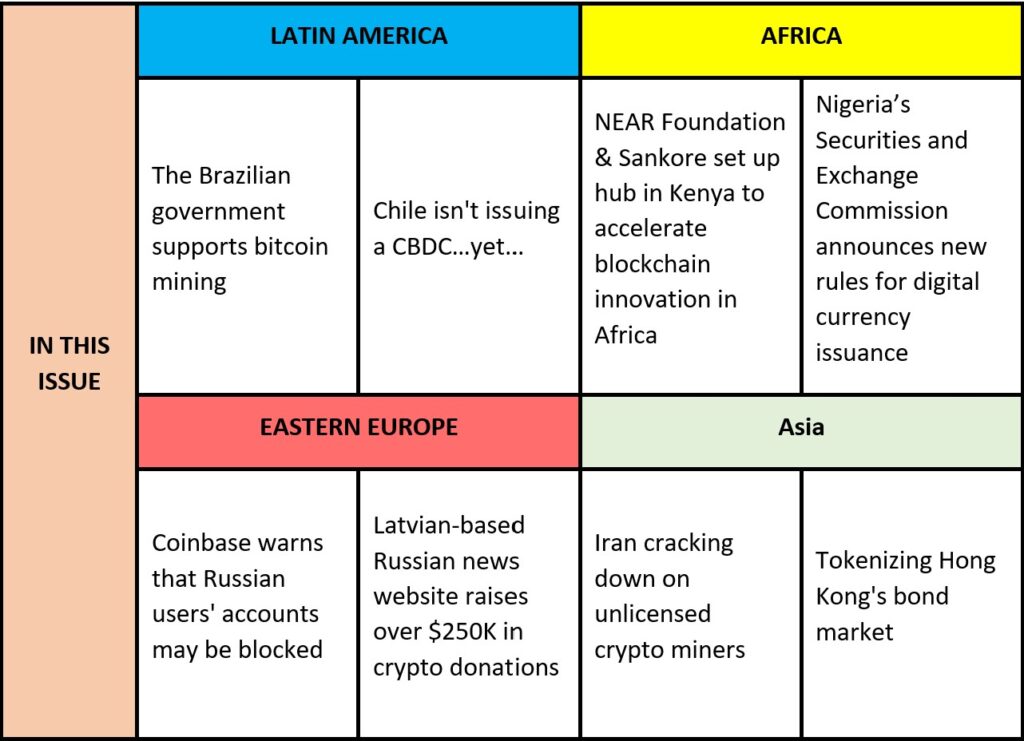

This is EmergingCrypto.io’s weekly newsletter. To receive this in your inbox on Monday morning, you may subscribe here!

EmergingCrypto.io Weekly Update May 8 – May 14

Latin America

The Brazilian government supports bitcoin mining

Government support for crypto in Brazil continues to grow. In addition to the senate passing the ‘Bitcoin Law’ to regulate the Brazilian Industry (it’s not law yet, it still needs to pass in the Chamber of Deputies), Bitcoin and other proof-of-work cryptocurrency mining is the latest area to get support in order to encourage growth in this area of the broader crypto-economy. Starting today, May 16th, if you’re importing ASICs to Brazil, they will be exempt from import duty. Brazil’s Chamber of Foreign Commerce believes in the growth of the blockchain-based economy. Supporting local miners’ ambition is the latest chapter of the blossoming blockchain and crypto economy in the Latin American giant. (Read more on EmergingCrypto.io; Read more on Blocknews)

Chile isn’t issuing a CBDC…yet…

Chile does not look to be the next country to launch a central bank digital currency (CBDC) this year. In a report published last week by the Central Bank of Chile, it highlighted that the introduction of a CBDC will support the country’s digital transformation and continued development of the country’s payment system. However, the report concluded that the debut of a digital peso will be delayed and requires deeper analysis of the risks and benefits. A follow up report is expected at the end of this year. (Read more on EmergingCrypto.io; Read more on UNLOCK Blockchain)

Africa

NEAR Foundation & Sankore sets up hub in Kenya to accelerate blockchain innovation in Africa

Last week the NEAR Foundation and Sankore, a Kenya-based NEAR guild, announced the launch of a regional innovation hub that will be based in Kenya and managed by the Sankore team. The Regional hub plans to accelerate blockchain education, innovation, and talent development across the continent. The NEAR Foundation is investing heavily in regional innovation hubs and the Kenya-based hub joins a team of hubs around the world including Ukraine, the Balkans, and China. (Read more on EmergingCrypto.io; Read more on BitcoinKE)

Nigeria’s Securities and Exchange Commission announces new rules for digital currency issuance

Nigeria’s SEC published new rules on the issuance and custody of digital currencies. The rules cover (1) the issuance of digital assets as securities, (2) registration requirements for Digital Assets Offering Platforms (DAOPs), (3) registration requirements for Digital Asset Custodians (DACs), (4) Virtual Asset Service Providers (VASPs), and (5) Digital Asset Exchange (DAX). The new rules specify that entities or individuals planning to raise funds via an initial coin offering or private token sale must submit an “assessment form and the draft white paper”, give an overview of the digital asset being offered, the value of each token, and buyer privileges. Nigeria continues to be one of the most active markets for digital currencies in Africa. In addition to being a center for fintech and crypto entrepreneurship, it’s also a leader in Central Bank Digital Currencies with its development and issuance of the e-naira. (Read more on EmergingCrypto.io; Read more on Bitcoin.com)

Eastern Europe

Coinbase warns that Russian users’ accounts may be blocked

Coinbase is warning some Russian users that unless they can provide documentation proving that they’re not subject to EU sanctions their accounts may be blocked on May 31, 2022. After that date funds left in their Coinbase accounts will be frozen and any assets transferred into the account will be blocked. In April Binance similarly decided to limit services to Russian nationals and companies to comply with EU sanctions. (Read more on EmergingCrypto.io; Read more on CoinNewsExtra)

Latvian-based Russian news website raises over $250K in crypto donations

Crypto-based crowd funding is helping the independent Latvian-based Russian (and English) language news website, Meduza. Reporting on the “Real Russia”, Meduza has been banned in Russia and cut off from their Russia-based financial supporters and advertisers. Furthermore, donations have been hampered by the Russian ban on the SWIFT network. Facing a financial crisis that’s affecting their solvency, the news organization asked their supporters for help and has been able to raise over $250K in crypto-based donations in bitcoin, ether, Binance coin, Tether, Monero, and Zcash. Publishing daily articles on Russia’s war against Ukraine, the donations will help their 25 journalists who have fled Russia to resettle in Riga, Latvia, where the company’s headquarters is based. (Read more on EmergingCrypto.io; Read more on Cointelegraph)

Asia

Iran cracking down on unlicensed crypto miners

Iran is a relatively friendly country to mine crypto since the mining industry was legalized and regulated in July 2019. Miners who want to set up shop there need approval by the Ministry of Industries and obtain a license. However, regulating the sector isn’t encouraging all miners to follow the established rules. Registered miners are required to buy electricity at higher rates that eat away at their profitability. As a result, an underground industry of unlicensed crypto miners has flourished. As miners try to operate under the radar, Iran’s Power Generation, Distribution, and Transmission Company (Tavanir) has been cracking down on underground crypto farms. In the past two years nearly 7,000 unlicensed crypto farms have shutdown. Collectively these unlicensed facilities have used about 645 megawatts of electricity, equal to the annual electricity consumption of three major regions in Iran — North Khorasan, South Khorasan, and Chaharmahal-Bakhtiari. Iran has been experiencing electricity shortages that were partially blamed on the usage by crypto miners. (Read more on EmergingCrypto.io; Read more on Bitcoin.com)

Tokenizing Hong Kong’s bond market

Rounding of this week’s newsletter, Forkast published an analysis discussing the concept of tokenizing fixed income products in Hong Kong. Tokenizing bonds has the potential to transform the Hong Kong market by making it more transparent, reliable, and efficient. Utilizing smart contracts for automation, fixed income products are well-positioned for tokenization because they have set schedules for coupon payments and principal repayment. Tokenized bonds on virtual asset exchanges can be traded 24/7/365, they can facilitate more liquidity, and fees on virtual asset exchanges may be lower than traditional brokerage fees. However, there are some disadvantages. Virtual asset exchange fees, such as ones built on top of Ethereum, need to be paid in cryptocurrencies vs. fiat. Furthermore, layer-1 protocols like Ethereum, that rely on proof-of-work to achieve consensus and mine new coins are criticized for the amount of energy they use to secure the network. Hong Kong regulators have also advised that virtual asset dealing and services can only be provided to professional investors, limiting the investor base which may dissuade tokenizing bonds. In summary, there are clear benefits to tokenizing fixed income products. However, the regulatory environment is still being developed to balance investor protection with growing the technology and market. (Read more on EmergingCrypto.io; Read more on Forkast)

Thanks for reading! Have a great week ahead!

Written by Jon Lira. Connect with him on LinkedIn and Twitter.

Was this email forwarded to you? Sign up here