This is EmergingCrypto.io’s weekly newsletter. To receive this in your inbox on Monday morning, you may subscribe here!

Latin America

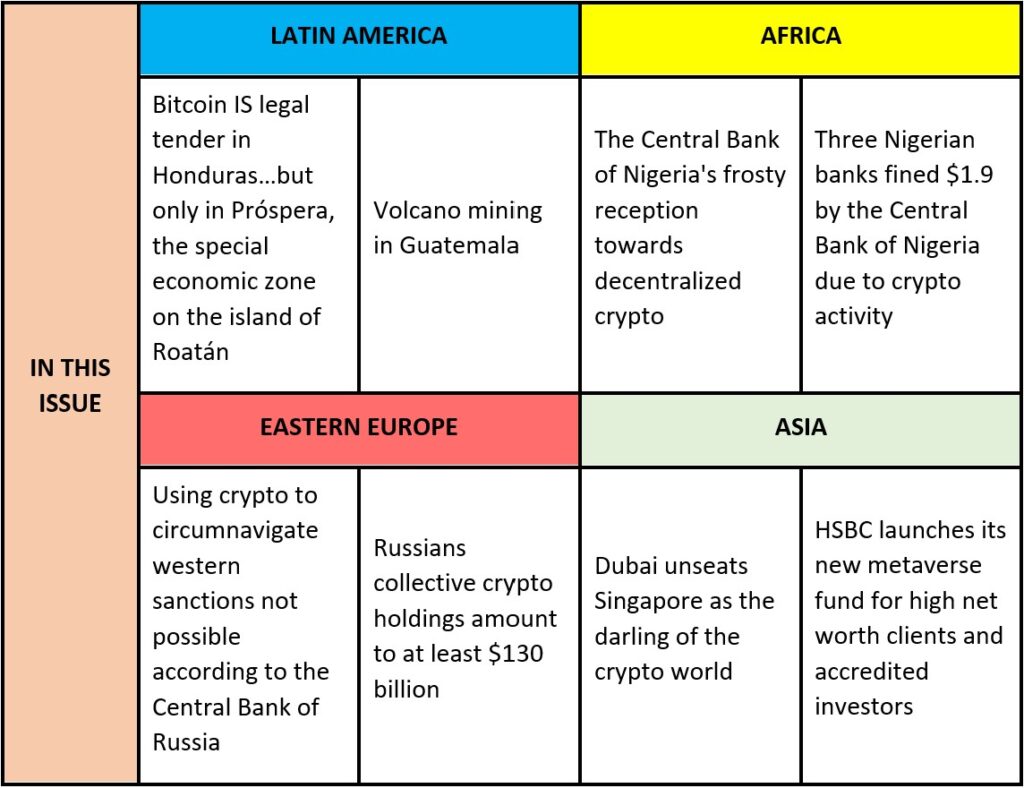

Bitcoin IS legal tender in Honduras…but only in Próspera, the special economic zone on the island of Roatán

Although bitcoin may not be legal tender in Honduras countrywide per the Central Bank of Honduras, last week the small Central American country made headlines again when it was announced that bitcoin and other cryptocurrencies will be legal currency in “Honduras Próspera”, a special economic zone on the island of Roatán in Honduras. “Próspera’s flexible regulatory framework enables crypto-innovation and the use of Bitcoin by residents, businesses, and governments” in a press release by Honduras Próspera. Furthermore, “municipalities, local governments, and international firms can issue Bitcoin Bonds from the Próspera ZEDE jurisdiction with world class KYC and AML standards, creating a new and accessible tool for attracting FDI and driving economic development in Honduras.” Meanwhile, Honduras’ neighbor, El Salvador, adopted bitcoin as legal tender last September, making El Salvador the first country in the world to do so. (Read on EmergingCrypto.io; Read on Blockchain.News)

Volcano mining in Guatemala

If you happen to have access to a volcano, you may want to consider leveraging its geothermal power to mine bitcoin. The idea of volcano mining began to be explored around the time El Salvador implemented bitcoin as legal tender. Now the town of Panajachel in Guatemala is jumping on the volcano mining bandwagon to utilize the renewable power provided by the volcanoes of San Pedro, Tolimán and Atitlán to mine bitcoin. The initiative is being run by the Bitcoin Lake project. Its founder, Patrick Melder, emphasized that “it is a free resource that can be used to mine bitcoin without harming the environment. In fact, my goal is for bitcoin mining to help provide an economic incentive to clean up the lake for the benefit of the people”, create jobs, and provide capital inflows to the region. (Read on EmergingCrypto.io; Read on Cointelegraph)

Africa

This week we will be spotlighting the Central Bank of Nigeria’s perspective on crypto. Africa’s most populous country, Nigeria and its people are some of the most enthusiastic when it comes to crypto use and adoption. However, the Central Bank of Nigeria isn’t as warm towards crypto as the general public is.

The Central Bank of Nigeria’s frosty reception towards decentralized crypto

Despite the promotion, investment, and introduction of the e-naira, Nigeria’s central bank digital currency (CDBC), the Central Bank of Nigeria (CBN) isn’t a fan of decentralized cryptocurrencies like bitcoin. They challenge the CBN’s authority and offer Nigerian’s an alternative store of value than the local currency. The decentralized networks provide a parallel infrastructure that disintermediates local banks. In addition, they provide a lower cost and faster alternative to transact internationally than what banks may be able to provide Nigerians. (Read on EmergingCrypto.io; Read on CoinNewsExtra)

Three Nigerian banks fined $1.9 million by the Central Bank of Nigeria due to crypto activity

While decentralized cryptocurrencies challenge the CBN’s authority, the central bank is hitting back and fining local commercial banks for allowing their customers to transact in cryptocurrencies. The three banks fined last week were Stanbic IBTC Bank ($480,207), Access Bank PLC ($1.2 million), and United Bank for Africa ($240,103). (Read on EmergingCrypto.io; Read on BitcoinKE)

Eastern Europe

Using crypto to circumnavigate western sanctions not possible according to the Central Bank of Russia

Cryptocurrencies and sanctions has been an important discussion topic due to the ongoing Russian war in Ukraine. Last week the First Deputy Chairman of the Bank of Russia, Ksenia Yudaeva, commented that the use of cryptocurrencies to circumvent sanctions, especially for large payments, is impossible. Considering the current geopolitical environment and regulatory pressure on crypto, the Central Bank of Russia explained that foreign regulators will require more transparency from cryptocurrency exchanges and financial intermediaries dealing in crypto. The central bank also indicated that relative to the existing payment infrastructure, crypto payments are impractical and can be detected, and blocked, by foreign regulators given the nature of public decentralized blockchains. (Read on EmergingCrypto.io; Read on 1prime)

Russians collective crypto holdings amount to at least $130 billion

Meanwhile, Russian prime minister, Mikhail Mishustin, citing “various estimates,” is claiming that Russians collectively hold more than $130 billion (10 trillion roubles) worth of crypto. If this figure is accurate, the collective value of Russian-owned crypto is fairly close to Russia’s official gold reserve, roughly $140 billion as of March 2022 as reported by Reuters. Despite the recent recovery in the rouble’s value, it comes to no surprise that many Russians have invested their wealth in crypto as a store of value given the negative impact of western sanction had on the rouble at the start of the war. (Read on EmergingCrypto.io; Read on Cointelegraph)

Asia

Dubai unseats Singapore as the darling of the crypto world

In 2021 Singapore was the darling of the crypto world. However, in 2022 Dubai is replacing Singapore as THE location for crypto companies to set up shop given it’s crypto-friendly regulatory environment and an easier path to receive a virtual asset service provider license. After China banned any crypto-related activities last year, many China-based companies relocated to Singapore. However, the Monetary Authority of Singapore has been very strict to provide a license to companies to operate on the island. The Financial Times reported last week that Exchange Bybit will be relocating its global HQ from Singapore to Duabi and joining industry heavyweights Crypto.com, FTX, and Binance who’ve all established an official presence in the Gulf nation. (Read on EmergingCrypto.io; Read on UNLOCK Blockchain)

HSBC launches its new metaverse fund for high net worth clients and accredited investors

Rounding off this week’s newsletter, HSBC continues its wager on the metaverse. The banking giant is providing a new investment product for its high net worth clients and accredited investors in Singapore and Hong Kong called the Metaverse Discretionary Strategy portfolio. According to Reuters, the fund will “focus on investing within the metaverse ecosystem across five segments – infrastructure, computing, virtualisation, experience and discovery, and interface.” This comes on the heels of HSBC’s announcement last month that they plan to buy land in The Sandbox metaverse. (Read on EmergingCrypto.io; Read on Cointelegraph)

Thanks for reading and have a great week ahead!

Written by Jon Lira. Connect with him on LinkedIn and Twitter.

Was this email forwarded to you? Sign up here